When people think of developing countries, the first thing that comes to mind is “power shortages.” In fact, Indonesia’s power industry has undergone significant development in recent years. In 2018, the country’s installed power capacity was only 64.9GW. By 2025, it had grown more than 90 GW, an average annual growth rate exceeding 6%. Continuing this development, the Indonesian government unveiled an ambitious program to develop 100 GW of solar power plant capacity.

However, Indonesia’s renewable energy transition has been sluggish compared to its regional peers. Despite a government target of 23% renewables in the national energy mix by 2025, the actual share remains around 13–14%. On the other hand, the coal-generated electricity still takes 60% shares. Indonesia still faces areas for improvement in its renewable energy transition, including streamlining regulations, expanding incentives, and reducing the costs. Addressing these issues would strengthen investor confidence, especially among global companies with strong net-zero commitments.

Indonesia’s 100GW Solar Power Plant could be a major turning point. Currently, Indonesia’s total installed power capacity is only about 80GW. This makes the 100GW solar initiative one of the country’s most ambitious energy projects. If successful, it could position Indonesia as a regional leader in the renewable energy transition. The plan also signals to global investors that Indonesia is serious about clean energy and long-term sustainability.

What is the content of Indonesia’s 100 GW Solar Power Plan?

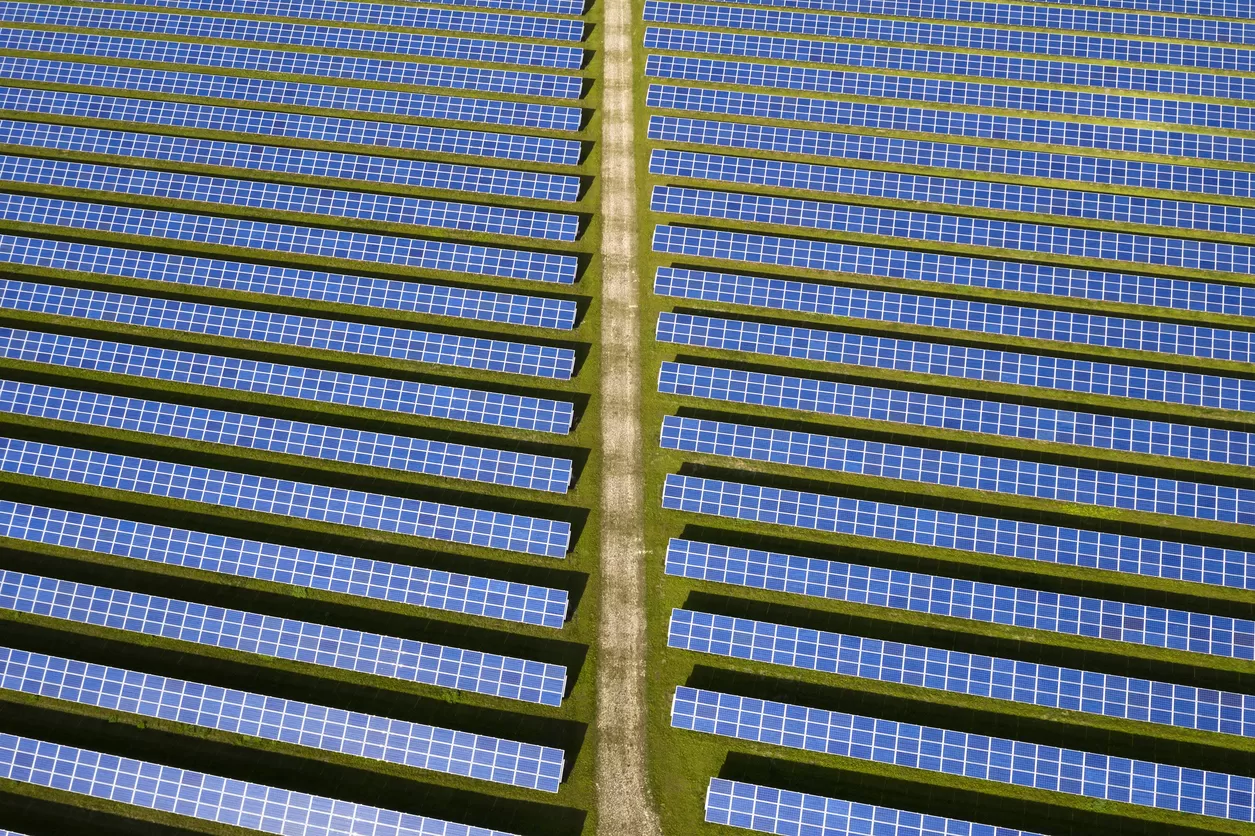

Recently, in August 2025, the Indonesian government unveiled an ambitious program to develop 100 GW of solar power plant capacity between 2025 and 2030. The plan is divided into two main schemes: 80 GW of village-based solar mini-grids and 20 GW of centralized solar power plants. Under the mini-grid scheme, around 80,000 villages will each be equipped with a 1 MW solar PV system paired with a 4 MWh battery. Meanwhile, the centralized projects, totaling 20 GW, will consist of on-grid and off-grid plants designed to complement and stabilize the national power distribution system.

The program aims to lower electricity costs in rural areas to around USD 0.12–0.15 per kWh, compared to the current diesel-based costs of USD 0.20–0.40 per kWh. Beyond affordability, it seeks to expand clean energy access, accelerate rural electrification, and strengthen Indonesia’s path toward its long-term solar target of 108.7 GW by 2060. In essence, this initiative represents a bold step toward decentralized renewable power and a stronger, more resilient energy network.

To support this massive rollout, the Ministry of Energy and Mineral Resources has begun engaging with leading solar manufacturers. One of the partnerships with Trina Solar in China is envisioned to secure supply chain resilience and encourage domestic module production. There are also initiatives underway to accelerate local solar manufacturing capacity, reducing reliance on imported components. The government estimates that an investment of around US$100 billion will be required for the village-based solar program.

Several existing projects provide early proof points for Indonesia’s capacity to execute solar developments. For instance, PowerChina has already connected a 100 MW solar PV plant at Karawang Industrial Park to the national grid. This demonstrates feasibility for large-scale grid-connected projects. On the smaller end of the spectrum, Sukaharja Village in Bogor Regency has implemented an off-grid solar-plus-battery system to power community facilities. This shows how localized models can empower rural areas and serve as prototypes for the broader 100 GW program.

Can the 100GW Solar Plant Change the Game?

The announcement of the Indonesia’s 100GW solar power plant program has the potential to be a true breakthrough for Indonesia. If fully realized, it would not only surpass Indonesia’s existing power generation capacity but also position the country as a leading force in Southeast Asia’s clean energy future.

Does it have a connection with foreign investors? Absolutely. If Indonesia can provide renewable energy on a large scale, the impact would be significant:

- Indonesia would be more attractive to global investors committed to net-zero targets (such as Apple, Google, Tesla, etc.)

- Strengthen the competitiveness of its industrial estates, giving foreign tenants greater confidence to establish operations.

- Enhance Indonesia’s reputation as a country serious about decarbonization.

That said, investors will not be convinced by plans alone. Investors will require more than ambitious targets—they will look for evidence of execution, regulatory consistency, and policy stability.